Navigating the Market: Understanding Stock Trends in 2025

Related Articles: Navigating the Market: Understanding Stock Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Market: Understanding Stock Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Market: Understanding Stock Trends in 2025

- 2 Introduction

- 3 Navigating the Market: Understanding Stock Trends in 2025

- 3.1 Factors Shaping Stock Trends in 2025

- 3.2 Tools and Techniques for Reading Stock Trends

- 3.3 How to Read Stock Trends in 2025

- 3.4 Related Searches

- 3.5 FAQs

- 3.6 Tips for Reading Stock Trends

- 3.7 Conclusion

- 4 Closure

Navigating the Market: Understanding Stock Trends in 2025

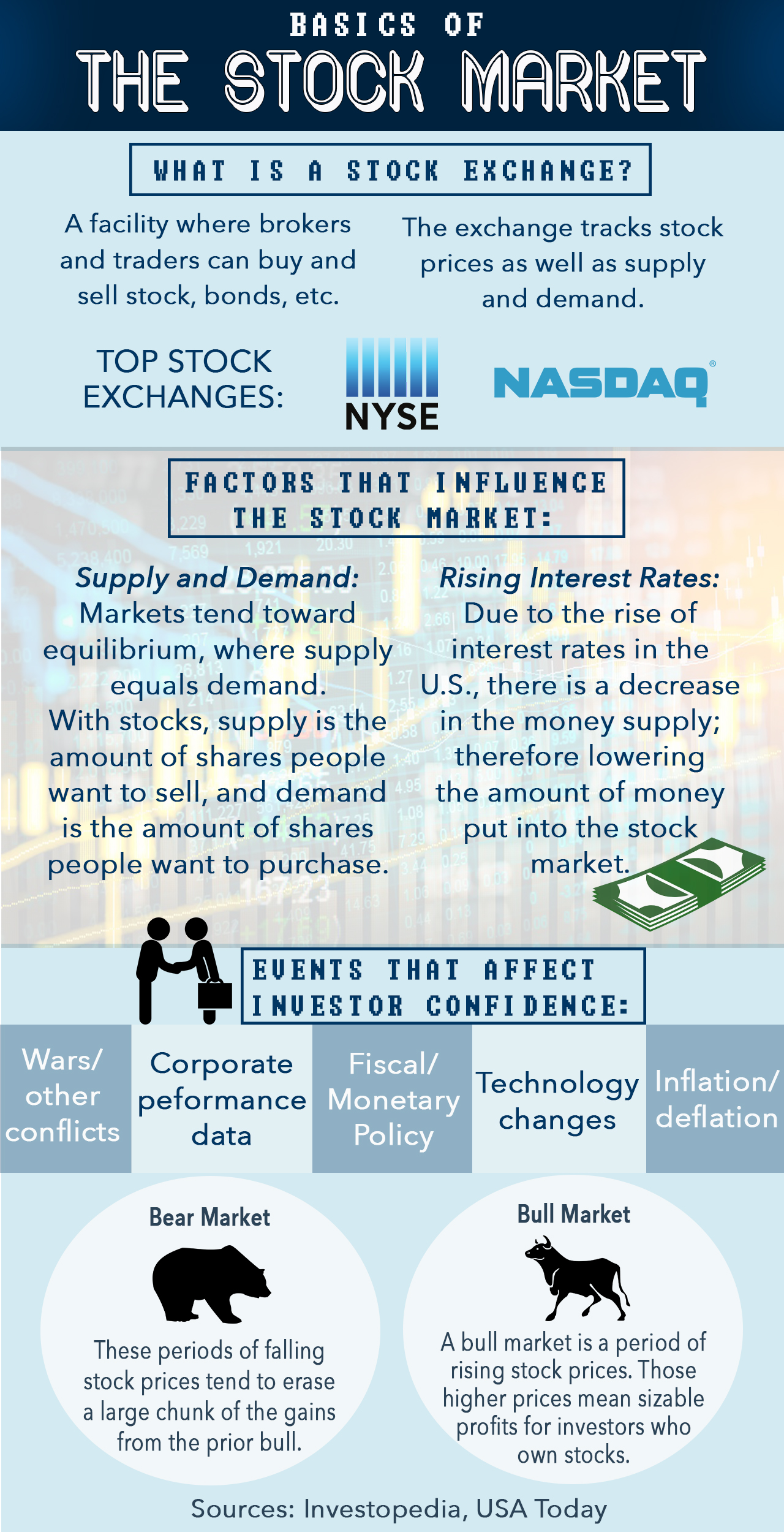

The stock market, a dynamic and complex ecosystem, presents both opportunities and challenges for investors. Understanding how to read stock trends is crucial for making informed investment decisions. This guide will explore the key factors influencing stock trends in 2025 and provide insights into how investors can navigate this evolving landscape.

Factors Shaping Stock Trends in 2025

1. Technological Advancements:

The rapid pace of technological innovation continues to drive significant change across industries. Artificial intelligence (AI), blockchain, and cloud computing are transforming business models and creating new growth avenues. Investors need to identify companies at the forefront of these advancements, as they are likely to experience significant growth in the coming years.

2. Global Economic Landscape:

The global economic outlook plays a crucial role in shaping stock market trends. Factors such as interest rates, inflation, and geopolitical events can significantly impact investor sentiment and market performance. For example, rising interest rates can make borrowing more expensive, potentially impacting corporate investment and economic growth.

3. Sustainability and ESG Investing:

Environmental, social, and governance (ESG) considerations are increasingly influencing investment decisions. Investors are seeking companies with strong sustainability practices and ethical business models. This trend is expected to continue in 2025, with investors favoring companies that prioritize environmental responsibility, social impact, and good corporate governance.

4. Demographics and Consumer Behavior:

Changing demographics and evolving consumer preferences are also shaping stock market trends. The aging population, rising disposable incomes in emerging markets, and growing demand for digital products and services are all influencing investment opportunities.

5. Regulatory Environment:

Government regulations and policies can significantly impact stock market performance. Changes in tax laws, trade agreements, and environmental regulations can create both opportunities and challenges for businesses. Investors need to stay informed about evolving regulatory landscapes and their potential impact on different sectors.

Tools and Techniques for Reading Stock Trends

1. Fundamental Analysis:

Fundamental analysis involves evaluating a company’s financial health, management, and industry position. By examining factors such as revenue growth, profitability, debt levels, and competitive landscape, investors can gain insights into a company’s long-term prospects and potential for future growth.

2. Technical Analysis:

Technical analysis uses historical price and volume data to identify patterns and trends in stock prices. This approach focuses on identifying support and resistance levels, charting trends, and using technical indicators to predict future price movements.

3. Sentiment Analysis:

Sentiment analysis involves analyzing news articles, social media posts, and other sources to gauge investor sentiment towards specific companies or sectors. This can provide insights into market sentiment and potential price movements.

4. Market Research and Data Analysis:

Access to reliable market research and data is crucial for making informed investment decisions. This includes analyzing industry trends, competitor analysis, and macroeconomic data to gain a comprehensive understanding of the factors influencing stock prices.

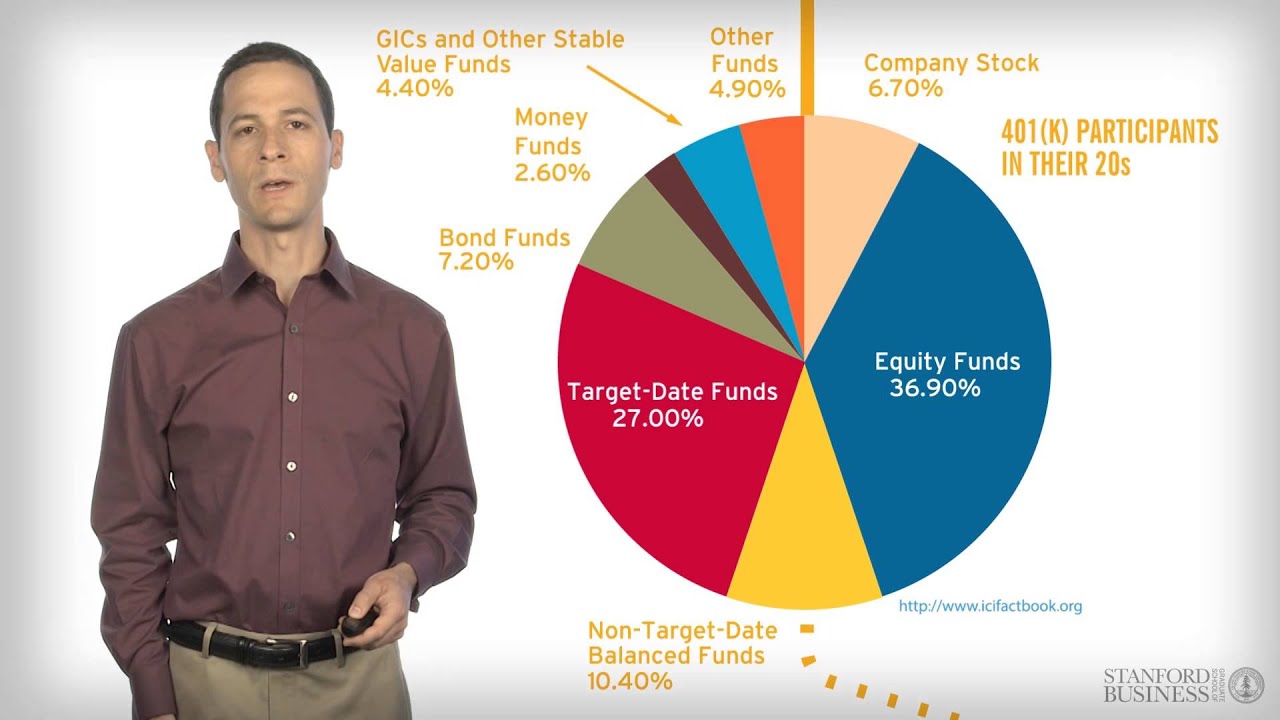

5. Portfolio Diversification:

Diversifying investments across different asset classes, sectors, and geographical regions can help mitigate risk and improve portfolio performance. This approach helps to reduce the impact of negative events on individual investments and provides a more balanced exposure to different market opportunities.

How to Read Stock Trends in 2025

1. Understand the Big Picture:

Start by analyzing the broader economic and geopolitical landscape. Factors such as interest rates, inflation, and global trade dynamics can significantly impact stock market performance. Stay informed about key economic indicators and geopolitical events that could influence investor sentiment.

2. Identify Industry Trends:

Focus on industries that are expected to experience significant growth in the coming years. Consider factors such as technological advancements, changing consumer preferences, and regulatory developments that are shaping different sectors.

3. Analyze Company Fundamentals:

Evaluate the financial health, management quality, and competitive position of individual companies. Look for companies with strong revenue growth, profitability, and a solid track record of innovation and sustainability.

4. Use Technical Analysis Tools:

Utilize technical analysis tools to identify patterns and trends in stock prices. Charting trends, identifying support and resistance levels, and using technical indicators can help you predict future price movements.

5. Monitor Market Sentiment:

Pay attention to investor sentiment, which can be a leading indicator of market direction. Analyze news articles, social media posts, and other sources to gauge investor confidence and potential price movements.

6. Seek Professional Advice:

Consider consulting with a financial advisor to get personalized investment guidance. A professional can help you develop a comprehensive investment strategy tailored to your individual needs and risk tolerance.

Related Searches

1. Stock Market Predictions 2025:

Investors are always looking for insights into future market trends. Analyzing historical data, macroeconomic indicators, and industry trends can provide valuable insights into potential market movements.

2. Best Stocks to Buy in 2025:

Identifying companies with strong growth potential and a solid track record of performance is crucial for successful investing. Researching industry leaders, emerging technologies, and companies with strong ESG practices can help investors discover promising investment opportunities.

3. Top Performing Stocks 2025:

Understanding which stocks have outperformed the market in previous periods can provide valuable insights into potential future winners. Analyzing historical data, industry trends, and company fundamentals can help investors identify potential outperforming stocks.

4. Stock Market Trends Analysis:

Analyzing historical stock market data, identifying patterns and trends, and understanding the factors influencing market movements are essential for making informed investment decisions. This involves using technical analysis, fundamental analysis, and market research to gain a comprehensive understanding of market dynamics.

5. Stock Market Forecasting:

Predicting future stock market movements is a complex task, but analyzing historical data, economic indicators, and industry trends can provide insights into potential market scenarios. However, it’s important to remember that market forecasting is not an exact science and involves inherent risks.

6. Stock Market Volatility:

Understanding the factors that contribute to stock market volatility is crucial for managing risk and making informed investment decisions. This involves analyzing news events, economic indicators, and geopolitical developments that can influence market sentiment and price fluctuations.

7. Stock Market Crash 2025:

While predicting market crashes is difficult, understanding the factors that can trigger market downturns is essential for managing investment risk. This involves analyzing historical data, macroeconomic indicators, and potential economic and geopolitical risks that could impact market stability.

8. Stock Market Bubbles:

Identifying and understanding potential stock market bubbles is crucial for mitigating investment risk. This involves analyzing valuation metrics, investor sentiment, and industry trends to identify potential overvaluation and potential market corrections.

FAQs

Q: How can I learn more about reading stock trends?

A: There are numerous resources available to help you understand stock market trends. Online courses, books, and articles can provide valuable insights into fundamental and technical analysis, market research, and investment strategies. You can also seek guidance from financial advisors or join investment communities to learn from experienced investors.

Q: What are the biggest risks associated with investing in the stock market?

A: Investing in the stock market carries inherent risks, including market volatility, economic downturns, and company-specific risks. It’s important to diversify your investments, manage your risk tolerance, and stay informed about market trends to mitigate potential losses.

Q: How can I stay updated on stock market news and trends?

A: Stay informed about market news and trends by subscribing to financial news websites, reading industry publications, and following financial analysts on social media. You can also use financial news aggregators to access a comprehensive overview of market developments.

Q: What are some tips for beginners interested in investing in the stock market?

A: Start by learning the basics of investing, including fundamental and technical analysis, risk management, and portfolio diversification. Choose a reputable brokerage platform, start with a small amount of capital, and invest in companies you understand and believe in.

Q: How can I protect my investments from market volatility?

A: Diversifying your portfolio across different asset classes, sectors, and geographical regions can help mitigate risk. You can also consider investing in low-volatility stocks or using hedging strategies to protect your investments from market downturns.

Q: What are the ethical considerations involved in investing in the stock market?

A: Investors should consider the ethical implications of their investment decisions. This includes investing in companies with strong ESG practices, avoiding companies involved in unethical or harmful activities, and supporting businesses that promote social and environmental responsibility.

Tips for Reading Stock Trends

1. Focus on Long-Term Growth:

Avoid chasing short-term gains and focus on investing in companies with strong long-term growth potential. This involves analyzing company fundamentals, industry trends, and the overall economic outlook.

2. Manage Your Risk Tolerance:

Understand your risk tolerance and invest accordingly. Don’t invest more than you can afford to lose and diversify your portfolio to mitigate risk.

3. Stay Informed and Adaptable:

The stock market is constantly changing, so stay updated on market news, industry trends, and economic developments. Be prepared to adjust your investment strategy based on new information and changing market conditions.

4. Seek Professional Guidance:

Consider consulting with a financial advisor to get personalized investment advice. A professional can help you develop a comprehensive investment strategy tailored to your individual needs and risk tolerance.

Conclusion

Reading stock trends in 2025 requires a comprehensive understanding of the factors influencing market dynamics. By analyzing economic indicators, industry trends, company fundamentals, and investor sentiment, investors can make informed decisions and navigate the evolving market landscape. Remember to stay informed, manage your risk, and seek professional guidance when necessary. The stock market presents both opportunities and challenges, but with careful planning and a sound investment strategy, you can position yourself for success in this dynamic environment.

.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market: Understanding Stock Trends in 2025. We appreciate your attention to our article. See you in our next article!